Over the past decade, the UAE has steadily positioned itself as one of the most advanced and practical markets for crypto-enabled financial services. Unlike regions where cryptocurrency adoption is still driven mainly by speculation or trading platforms, the UAE has taken a more functional and regulated approach. Digital assets are increasingly viewed as a natural extension of the financial ecosystem, operating alongside fiat accounts, cards, payment instruments, and account-based services.

This mindset has shaped how crypto products are built and delivered. Rather than standalone trading applications, UAE-based fintechs increasingly focus on infrastructure that supports everyday financial activity. As a result, wallet technology in the region has evolved into a secure, compliant, and scalable foundation for managing digital assets within regulated financial environments.

For founders, CTOs, and product leaders, the question is no longer whether crypto should be included in financial products. That decision has largely been made. The real challenge lies in determining how crypto functionality can be embedded into a broader digital finance platform without compromising operational control, regulatory compliance, or long-term scalability. In this context, white label crypto wallets have emerged as a core building block, serving as the primary interface through which users interact with digital assets as part of a unified financial experience.

Why the UAE Is a Key Market for White Label Crypto Wallets

The UAE’s leadership in wallet-centric crypto solutions is the result of long-term structural development rather than short-term experimentation.

As banks, fintech companies, payment providers, and crypto businesses expand their services to include digital assets, demand has increased for wallet platforms that can be reused, extended, and customized without repeated redevelopment. At the same time, support for multiple blockchain networks, multi-asset portfolios, and multi-currency balances within a single wallet environment has become essential—particularly for companies planning regional expansion across the Middle East.

Understanding Crypto Wallets: Purpose and Function

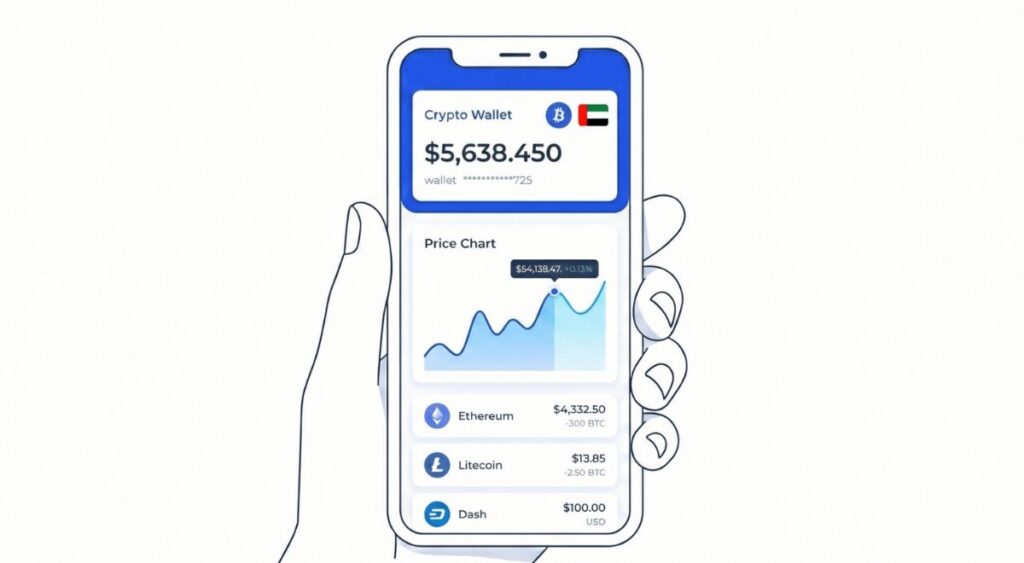

A crypto wallet is a software-based application that enables users to store, send, receive, and manage digital assets such as cryptocurrencies and NFTs. It acts as the gateway between users and blockchain networks, allowing secure interaction with decentralized systems while maintaining control over private keys.

The primary purpose of a crypto wallet is to ensure secure ownership and management of digital assets. As adoption of decentralized finance and blockchain-based services continues to grow, the demand for secure, intuitive, and reliable wallet solutions has increased significantly. This has led to the development of multiple wallet types, including mobile wallets, web wallets, desktop wallets, and hardware wallets, each offering different levels of accessibility and security.

Custom crypto wallet development allows businesses to tailor features such as multi-asset support, transaction history, blockchain integrations, biometric authentication, multi-factor authentication, and encryption. These security measures are critical for protecting private keys, safeguarding assets, and maintaining regulatory compliance.

White label crypto wallets offer an alternative approach, enabling organizations to launch fully branded wallet products quickly without building the entire infrastructure from scratch. These solutions allow companies to focus on user experience and growth while relying on proven wallet architecture and security frameworks.

A Financial Ecosystem Ready for Digital Assets

The UAE adopted digital payments and wallet-based services earlier than many other regions. Card payments, mobile wallets, and online transactions are now standard for both consumers and businesses. This maturity creates ideal conditions for integrating crypto into familiar financial interfaces rather than introducing entirely new user behaviors.

From a product perspective, crypto services can be embedded into existing wallet experiences, reducing friction and accelerating adoption. Hot wallets support frequent transactions and everyday use, while seamless interaction between fiat and crypto balances enhances usability and efficiency.

Crypto as Part of Everyday Financial Use

In the UAE, crypto is rarely positioned as a standalone product. Users increasingly expect a single financial environment where they can:

- Hold both fiat and crypto balances

- Convert between asset types seamlessly

- Perform token and cross-chain swaps within the wallet

- Make payments and transfers without understanding blockchain mechanics

Many wallets also support digital collectibles and NFTs, extending their functionality into broader Web3 ecosystems.

Dubai as a Regional Launchpad

For many fintech companies, Dubai serves as the entry point into the wider Middle East market. Products launched in the UAE are often designed for expansion into neighboring countries, making architectural flexibility a priority.

Wallet platforms must support multi-chain operations, regional configuration, and scalable compliance frameworks. Secure key management, regular security audits, and adaptable infrastructure are essential to support expansion without major system redesigns.

What “White Label Crypto Wallet” Means in the UAE

In the UAE context, a white label crypto wallet is far more than a branded interface. It is a wallet-led financial product where the operating company maintains full control over customer relationships, business logic, and compliance workflows.

This typically means the company:

- Owns and manages wallet accounts and balances

- Defines user experience and transaction rules

- Integrates external providers without embedding their logic into the core system

- Aligns wallet architecture with regulatory and commercial requirements

Crypto and fiat balances usually exist within a unified ledger system that records all transactions in real time. Secure management of private and public keys ensures asset protection and authorized access.

In this model, the wallet functions as the primary financial account rather than an add-on feature.

Common White Label Crypto Wallet Use Cases in the UAE

Consumer Wallets Combining Crypto and Fiat

These wallets allow users to store crypto, convert it into fiat, and spend funds using cards or local payment methods. The ledger ensures accurate balance management across conversions, and users expect a complete transaction history covering all activity.

Business and Corporate Wallets

Corporate wallets are used to manage operational funds in both crypto and fiat. They typically include multiple wallet accounts, role-based permissions, approval workflows, detailed reporting, and integration with accounting systems. Stability and auditability are critical in these use cases.

Wallets with Card Issuing

Many UAE fintech products link card issuing directly to wallet balances, allowing users to spend funds without interacting with crypto interfaces. This requires tight integration between wallet logic, card processing, and accounting systems.

Embedded Wallet Infrastructure

Some platforms use white label wallets purely as backend infrastructure, embedding wallet functionality into broader systems through APIs. In these cases, the wallet operates as a financial engine rather than a consumer-facing product.

Core Requirements of a Production-Grade Wallet

Across all use cases, mature fintech teams prioritize the same foundational elements:

- Support for multiple accounts and asset types

- Unified management of crypto and fiat balances

- Native card issuing and real-time balance updates

- Internal payments and transfers handled within the wallet core

- API-first architecture for integrations

- A real-time, double-entry ledger as the system of record

Ledger quality is often the deciding factor when selecting a wallet platform.

Architecture, Security, and Compliance

Early architectural choices have long-term impact. Successful wallet platforms in the UAE typically feature ledger-centric design, decoupled integrations, and built-in scalability.

Security expectations continue to rise, with biometric authentication, multi-factor authentication, encryption, and strong key management becoming standard. Non-custodial models are also gaining popularity as users seek greater control over their assets.

Compliance is embedded into daily operations. Wallet platforms must support unified audit trails, transaction monitoring, and role-based governance across both crypto and fiat flows.

Deployment Models: SaaS vs Source Code Licensing

SaaS deployments enable faster launches and reduced upfront costs, while source code licensing provides deeper control, customization, and predictable scaling. Many UAE fintechs adopt a phased approach, starting with SaaS and transitioning as their products mature.

Positioning Within the White Label Crypto Wallet Landscape

In the UAE and Middle East, white label crypto wallets are evaluated as part of a broader financial system rather than standalone products. The wallet is expected to support crypto, fiat, payments, and cards within a single operational framework.

Infrastructure-first wallet platforms align closely with this regional reality, enabling fintech teams to treat digital assets as a core component of long-term financial product strategies rather than optional features.