Dubai is moving towards becoming a digital hub globally to encourage international investments and economic growth. It has announced its virtual asset law as a global model for regulating cryptocurrency. The co-founder of Chainalysis stated that Dubai’s virtual asset law serves as a framework for all central banks and governments to manage cryptocurrency. In addition to protecting investors’ rights, it can be used to stimulate innovation and economic growth.

Dubai passed the regulation law for virtual assets earlier in February. The law is based on the objective of providing a legal framework. Let’s uncover what the law contains and how it protects crypto investors.

The New Law Holds Significant Importance for The Companies in the UAE

In the Middle East, cryptocurrency activity increased by $271.7 billion from July 2020 to June 2021, according to Chainalysis. The transaction reflects 6.6% of all crypto transactions around the world. UAE has jumped on the crypto bandwagon with its fast-growing market. The crypto transaction volume in Turkey is $132.4 billion, which is the highest among all from July 2020 to June 2021. After Lebanon and Turkey, UAE has secured the third position with its $25.5 billion in trade volume.

Irrespective of the growing crypto market in the Middle East, the crime rate in the crypto space is growing like a wild plant. Criminal activities, money laundering, and the cases of wash trade have dramatically increased, making the enactment of a strict regulatory system compulsory. NFT criminals alone amassed over $8.8 million in illegal earnings, according to Chainalysis. Such crimes are the main reason behind implementing the virtual asset law. UAE has become a prominent player in the crypto world, attracting more and more startups, investments, and projects. Due to enforcing the law, Dubai will be chosen as a market for companies to operate in the crypto space or a launchpad for new operations.

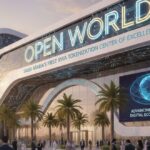

Dubai Established a Regulatory Body for Virtual Assets

Dubai has set up a regulatory authority that will be considered an independent authority to manage and control crypto functioning in the emirate. The Virtual Asset Regulatory Authority will also regulate the special development zones and free zones but the Dubai International Financial Centre will be excluded from its operations.

In addition to controlling and managing virtual assets including BTC and NFTs, the authority also has legal and financial dominance over the industry. Further, it will be linked to DWTCA. Due to its unpredictability, risky character, illegal behavior, and lack of regulatory control, central banks throughout the world have been hesitant to embrace cryptocurrencies. However, this virtual asset law has been presented as a model to regulate cryptocurrencies, and it enables central banks to accept crypto as legal tender.

Virtual Assets Regulatory Authority: The Key Features

Virtual Assets Regulatory Authority (VARA) has some key features to offer. As a legal entity, it will have financial and administrative sovereignty. VARA will be able to impose regulations on virtual assets to protect investors and participants. It will have the authority to manage the entire NFT offering and issuance procedure including regulating and operating digital assets. Moreover, it will coordinate with different governmental bodies and state officials to develop ethical standards, legislative frameworks, and policy plans.